STAXX CLUB Newsletter December 2025

Welcome, Staxx Club supporters! As we wrap up 2025 and ring in the new year from goldmannstaxx.com, this edition recaps the final month of a turbulent year in crypto. We’ll cover key Bitcoin and crypto news from December, pricing trends, a year-end analysis, major events, and forward-looking predictions for 2026. Despite market challenges, the industry’s fundamentals remain strong—let’s dive in!

December 2025 Crypto News Highlights:

December capped off a year of highs and lows with cryptocurrencies trending downward on the last trading days. Bitcoin and Ethereum both posted losses for the month, reflecting broader market fatigue after earlier surges. Currently stuck in an accumulation pattern, it appears yolo longs will continue to get rinsed until market conditions change. Seldom do prices surge when everyone expects them to.

Pricing and Market Performance

Bitcoin closed December—and the year—below $90,000, trading around $87,500 on New Year’s Eve, down from its 2024 close of $95,650. This marked a roughly 6-8% annual decline, despite an intra-year new all time high above $126,000. Ethereum also ended down, though specific end-of-year figures hovered in the low $3,000s.

| Metric | Bitcoin (End of 2025) | Notes |

|---|---|---|

| Closing Price | ~$87,500 | Down ~8% from 2024 close of $95,650. |

| Yearly High | $126,000 | Reached in early October before the crash. |

| Yearly Low | ~$50,000 (est.) | Post-crash dips contributed to volatility. |

| Market Cap (Crypto Total) | ~$2.5-3T (end-year) | Peaked at $4T in October before retracting. |

Volatility narrowed in December, with weaker demand signaling indecision into the new year.

Year-End Analysis:

2025 was a pivotal year for crypto: a mix of record highs, regulatory progress, and face melting corrections.

The crypto market cap hit $4 trillion at its peak, driven by U.S. policy shifts under President Trump, who aimed to position the U.S. as a crypto leader. However, a “crypto cool off” phase in the latter half erased gains, with Bitcoin falling 30% from its ATH.

Predictions for 2026

Some analysts are bullish on a big rebound, citing Fed rate cuts, Trump support, and clearer regulations. Key points to consider as we start 2026:

- Bitcoin Price: Expected to break its four-year cycle. 2025 was the first time Bitcoin experienced a yearly price drop in the calendar year following a halving, closing below its starting price for the year and breaking from its historical post-halving bull patterns, despite a new ATH.

- Previously, the post-halving years of 2013, 2017, and 2021 all saw significant gains: Bitcoin rose over 5,500% in 2013 (from ~$13 to ~$754), about 1,200% in 2017 (from ~$968 to ~$13,850), and roughly 60% in 2021 (from ~$29,000 to ~$46,300).

-What does that mean? Only time will tell – but one thing is certain, global entities with trillions of dollars of capital are taking positions. The current price action could be attributed to more accumulation before another fiat printing fueled run. - Altcoins and Trends: Regulatory boosts for altcoins; growth in stablecoins, RWAs (real-world assets), AI integration, and record Mergers and Acquisitions are all positive headwinds for some sectors of crypto have been struggling.

- High-frequency trading, algos, and liquidity provision from firms like BlackRock/Fidelity mean they can absolutely hunt stops on over-leveraged longs, shake out weak hands during corrections, and stack sats at better averages. That late-2025 pullback from the $126k ATH (down ~30%) felt engineered at times — cascading liquidations, thin holiday liquidity, is a perfect setup for accumulation without driving price straight up.

- “Chop city until morale improves.” Translation: Short term trading could keep grinding sideways-to-down, hunting stops on over-leveraged longs, until the last stubborn retail trader finally capitulates and stops aping 50x perpetuals at every green candle. Only then does the real move start — when there’s no one left trying to front-run it.

- NFTs continue to evolve in a post 2020 hype market. While tokenization is taking a front seat in the limelight, NFT technology will be integrated in many systems. NFT tech makes sense for rewards and prepaid merchandise operations.

Market Outlook: Transformative growth with institutional capital; crypto’s role in finance deepens. As gates open to trillions of dollars of capital via retirement funds, even Michael Saylor’s bullish estimates might not be bullish enough.

Ethereum: could surge in the first half, fueled by institutional inflows and network enhancements, with some projections eyeing 10x returns longer-term. Treasury companies like Bitwise how have lofty goals such as acquiring 5% of the total supply. Larry Fink is quoted, “Every asset — can be tokenized.” 2026 could be the start of a mass onboard to tokenized assets, real estate, personal property, anything of value.

Solana: is set for a strong year, with bullish predictions of amid upgrades like Firedancer and a booming stablecoin ecosystem potentially hitting $1 trillion.

Ripple’s XRP: might be benefiting from regulatory wins, ETF approvals, and expanded blockchain use cases.

These trends, alongside broader themes like AI integration, real-world asset tokenization, and record mergers, signal transformative growth across the crypto landscape.

Closing Thoughts:

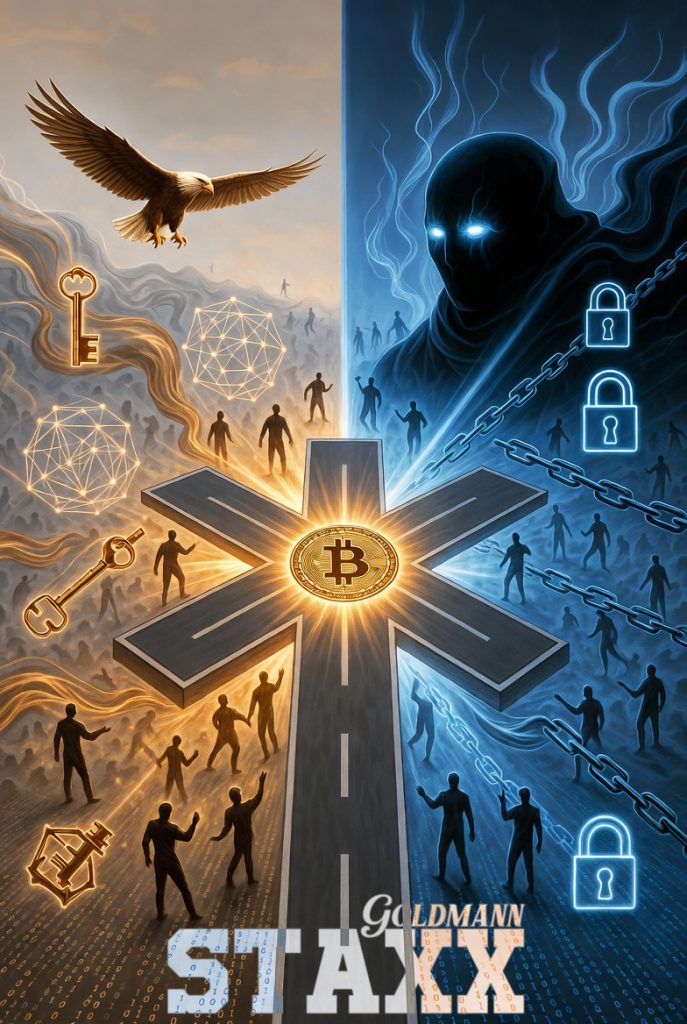

In an era where blockchain and tokenization promise financial revolution, figures like Larry Fink are champion digitizing assets for efficiency and accessibility. While that sounds great, we need to understand how dangerous it is to let crypto be turned into a dystopian tool for control. Education is key, we do not want to erode privacy through immutable ledgers that track every transaction forever, enabling programmable money like CBDCs to restrict spending based on behavior or compliance, and linking digital identities to social credit systems that turn ownership into conditional privileges. All while centralized giants like BlackRock co-opt the tech for profit over true decentralization, urging us to demand privacy-first designs before it’s too late. We can not afford to mess this up. The future of humanity could be at stake.

Stay vigilant, stay informed and stay stacked, Staxx Club! 2026 could be a massive year for prices and the US Federal Reserve is firing up the printing presses. Learn how to protect you and your family from inflation. Follow us for real-time updates, and join our events. Questions? Hit reply!

The Staxx Club Team

goldmannstaxx.com

STAXX RACING –

Keep an eye on our updates for announcements and come see the action up close!

Sick Week 2026 drag and drive event in Florida USA is set -> make sure to support the event if you can!!! Stay safe and have fun this holiday season!

Staxx Tip of the Month

Tip: Don’t get caught up in the short term trading hype if your goals are long term. Set a goal, make a list of smaller tasks with a plan and start checking things off the list. We hope you have a blessed and profitable 2026.

Want personalized advice?

Swing by the socials for a one-on-one with our resident crypto crew.

STAXX Club NFT Holder Perks

Coming soon: WE ARE LOOKING TO EXPAND NFTs on other chains – more info to follow.

All holders of the STAXX.CLUB NFT on WAX network are receiving perks as decided on by the community.

(Monthly Drops January 31 2022 – December 31 2024)

For more info go here : https://goldmannstaxx.com/staxx-club-hologram-nft-blend/

Join the Conversation!

Stay connected with us on all our social media platforms to keep up with the latest news, events, and special offers. We’re building a vibrant community, and we want you to be a part of it.

If you’re not already a follower of the Goldmannstaxx STAXX CLUB, now is the perfect time to hook yourself up! Our community is made up of all kinds of individuals who share a common interest in Bitcoin, cryptocurrencies, NFTs, entertainment, and the future of finance.

As a supporter, you’ll gain access to exclusive events, educational resources, and a supportive network of like-minded individuals.

Visit our Link Tree: https://linktr.ee/goldmannstaxx

We look forward to bringing you more exciting updates next month!

Stay Staxxy!

The Goldmann Staxx Team

PLANS

– Website 3.0 and product development

– #STAXXRACING Events and content

– STAXX.CLUB Tutorials, events and information

– Tons more content from the markets, metaverse, and beyond!

– We keep it real

– We provide real analysis based on facts and information available. Adding value to our clients, supporters and club members at the same time, its a beautiful thing.

– Supporting our organization is easy, just hit some buttons!

– We have exposed countless people to bitcoin and crypto in a supportive and non threatening way.

– We have given out Bitcoin, thousands of NFTs, cryptos and schwag to people all over the world!!!

CANT STOP – WONT STOP

Join us on Telegram, Facebook, Twitter X, Youtube, TikTok, Discord, Instagram, and/ or Twitch!!!

Hit the buttons on the socials – THANK YOU FOR YOUR SUPPORT!